EU orders after Brexit

As you are no doubt aware, the UK finally left the EU on 1 January 2021. As the UK is now outside of the EU, it means that we have to operate within different frameworks than before and these will have an effect on how we deal with your order, and the process you go through to receive it. This page is intended to give you important information so that you can make a decision about whether to proceed with your order

It should be noted that this information is in addition to the information found on our Payment & Delivery page and within our Terms & Conditions, and you should make sure you read those as well.

VAT and import charges

Now that the UK has left the EU, we have joined a scheme called the Import One Stop Shop (IOSS). More details about this can be found by clicking here. For qualifying orders, we will charge the appropriate level of VAT at the point of sale.

For EU orders that do not qualify for IOSS (and for all non-EU orders), we do not charge VAT but it should be noted that you may be liable for import duties, taxes or other charges before you can take delivery of your order.

Where IOSS does not apply, and where import charges may be payable, these may vary from country to country and with the value of the goods being shipped. If you need further information about charges that may be levied in your country, please contact your local Customs Authorities.

Please be aware that any charges that may be levied are the responsibility of the person receiving the goods.

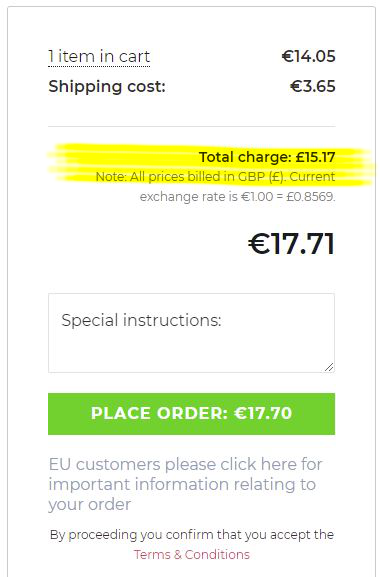

Our prices are in pounds sterling Whilst the facility exists on our website to display prices in Euros, as noted on our Payment & Delivery page, all of our charges are made in pounds sterling.

Whilst the facility exists on our website to display prices in Euros, as noted on our Payment & Delivery page, all of our charges are made in pounds sterling.

This means that - depending on the exchange rate your bank or card issuer is using at the time of your order - you may pay slightly more or slightly less than the Euro equivalent that is displayed.

The final total in pounds sterling is always shown on the checkout before you complete the order, and on the invoice that is presented once the order is complete.